Donor Advised Funds

Makes Philanthropy simple and easy

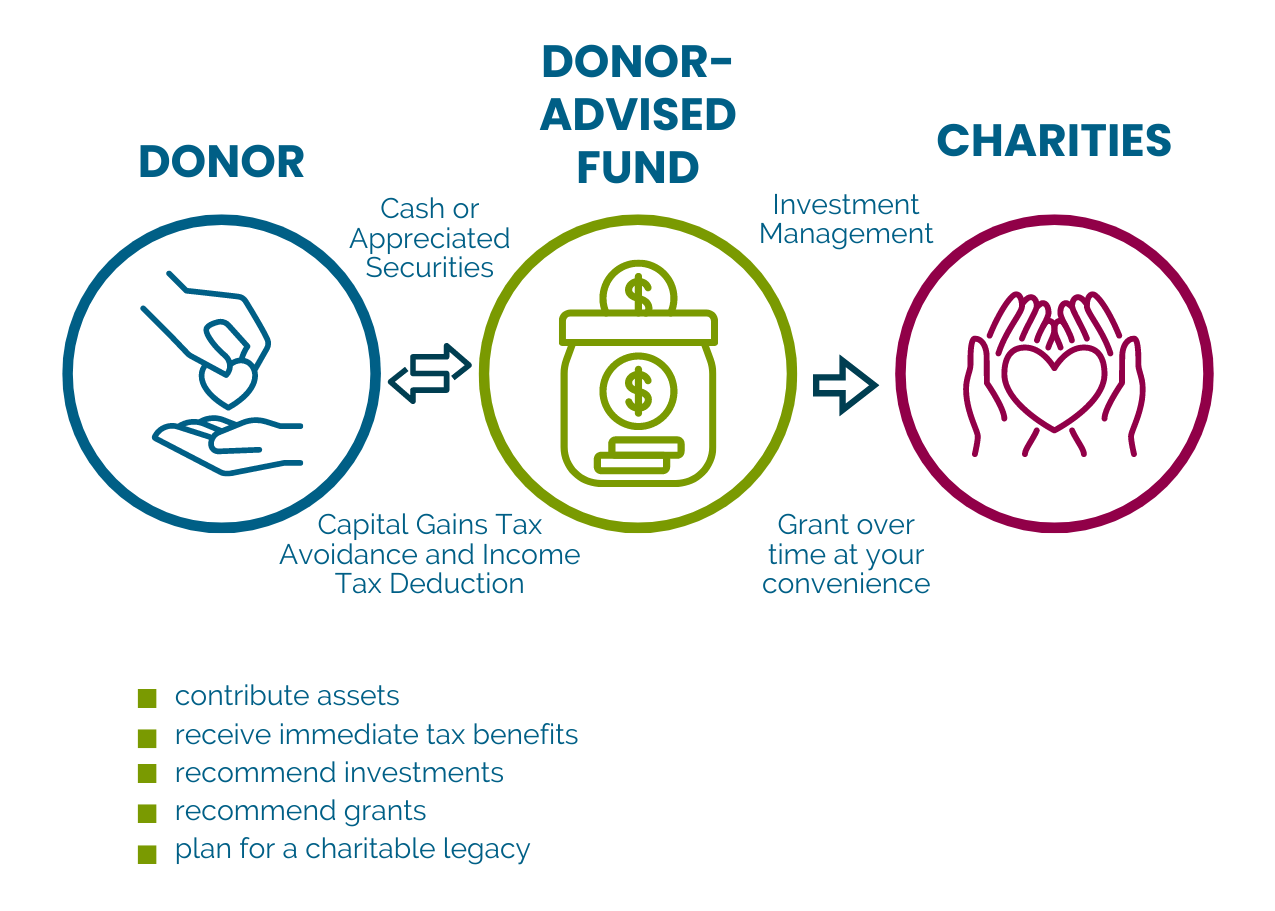

A Donor Advised Fund at Community Foundation of greater Greensboro (CFGG) offers the advantages of a private foundation without the set-up costs, ongoing excise taxes, and administrative expenses. Your gift receives more advantageous tax treatment, as well as reduced expenses and burdens, because CFGG is a public charity.

A donor-advised fund at the Community Foundation makes philanthropy simple and easy. You can be as active as you want to be and still support the issues and organizations that matter most to you.

- Gifts from your fund will be made in your name or the name you choose for your fund. Your gift can also be anonymous.

- You will receive immediate tax benefits, even if grants from your fund occur over time.

- Your assets will grow through investment, allowing your giving capacity to increase.

- You can give away as much or little as you like, and you can endow your fund as a legacy in perpetuity.

What are the differences?

CFGG Donor Advised Fund vs. a Private Foundation

A Donor Advised Fund at Community Foundation of Greater Greensboro (CFGG) offers the advantages of a private foundation without the set-up cost, ongoing excise taxes, and administrative expenses. Your gift receives more advantageous tax treatment, as well as reduced expenses and burdens, because CFGG is a public charity.

CFGG DONOR ADVISED FUND

PRIVATE FOUNDATION

| No set-up fees | Substantial set-up costs (legal, accounting, filing, fees) |

| No annual distribution requirement | 5% annual distribution requirement |

| No excise taxes | Excise taxes, typically 2% of annual income |

| Income tax deductions | Income tax deductions |

| Cash: Up to 60% of adjusted gross income | Cash: Up to 30% of adjusted gross income |

| Appreciated, long-term securities: Fair market value up to 30% of adjusted gross income | Appreciated, long-term securities: Fair market value up to 20% of adjusted gross income |

| Long-term real estate and closely held securities: Fair market value up to 30% of adjusted gross income | Long-term real estate and closely held securities: Deductible at cost basis |

| Donor may choose to remain anonymous | Tax return is public record (form PF 990) |

CFGG Donor Advised Fund vs. a Commercial Donor Advised Fund

With their deep community connections, community founations are able to provide donors extensive knowledge about local issues, as well as unique insights into the causes that individual donors care about.

CFGG DONOR ADVISED FUND

COMMERCIAL DONOR ADVISED FUND

| Counseling on where your money can do the most good, based on your goals and interests | Limited, if any, philanthropic advice; grantmaking transactional requests |

| Deep local knowledge across variety of evolving or emerging community issues | Limited, if any, local presence; grants accepted through national office |

| Opportunities to engage with local community through membership on CFGG committees and boards | Grantmaking only |

| Invitation to donor events including networking and educational activities | No donor events |

| Fees support programs in the community through CFGG | Fees support financial parent company’s national foundation |

What are the benefits?

1. Knowledge of local organizations and the causes important to the community. CFGG works with nonprofits in our community every day and we can provide valuable information to assist you in planning your philanthropy. | 5. Strategic giving. Partner with CFGG to fund grants in areas that strengthen the community 6. Make a difference in perpetuity. Name a second generation of advisors to a Donor Advised Fund. |

2. Simplified recordkeeping. We keep track of your donations, providing timely gift acknowledgments, and we use professional money managers for endowed assets. Statement access is provided securely online. 3. Tax timing advantages. It may make sense to make larger charitable contributions in some years more than in others. With a Donor Advised Fund, you can make contributions in years when it’s more advantageous, and then make charitable distributions in subsequent years — without having to add to the fund each year. 4. Fast and easy set-up. A non-endowed Donor Advised Fund can be opened in a day, with a simple one-page agreement and an initial gift of $10,000 or more. An endowed Donor Advised Fund is established with an agreement and can be set up in a few days with an initial gift of at least $25,000. | 7. Modest fees. A Donor Advised Fund is typically less costly and easier to administer than other forms of organized giving, such as family or corporate foundations. 8. Anonymous charitable grants. If desired, you can make grants anonymously on a grant-by-grant basis. 9. No capital gains taxes on appreciated securities. If you have stocks or bonds purchased more than a year ago that are worth more now than when you bought them, you will not have to pay capital gains taxes on the earnings if you give them to CFGG. 10. Increased giving capacity. When you open a Donor Advised Fund, your initial gift can grow significantly over time, and all growth in the fund is tax-free. |

Donor Advised Fund

-

No set-up fees

-

No annual distribution requirement

-

No excise taxes

-

Income tax deductions

-

Cash: Up to 60% of adjusted gross income

-

Appreciated, long-term securities: Fair market value up to 30% of adjusted gross income

-

Long-term real estate and closely held securities: Fair market value up to 30% of adjusted gross income

-

Donor may choose to remain anonymous

Private Foundation

-

Substantial set-up costs (legal, accounting, filing, fees)

-

5% annual distribution requirement

-

Excise taxes, typically 2% of annual income

-

Income tax deductions

-

Cash: Up to 30% of adjusted gross income

-

Appreciated, long-term securities: Fair market value up to 20% of adjusted gross income

-

Long-term real estate and closely held securities: Deductible at cost basis

-

Tax return is public record (form PF 990)

Our Impact

Our goal as a charitable organization is to create a lasting impact in the Greensboro Community. We do this by building strong relationships with philanthropists and nonprofit organizations to understand goals and meet the needs of the community. Visit our blog to read the latest news and see the positive impact on our community when we work together.