Investment Options

The Community Foundation of Greater Greensboro offers four primary investment

Collaborating with us empowers financial advisors to offer philanthropic solutions that align with your client’s financial goals and charitable aspirations. As a trusted partner, the Community Foundation provides expert guidance and tailored strategies to enhance your client relationships. Join us in building a legacy of impact in Greater Greensboro by integrating philanthropy seamlessly into your practice. Together, we can achieve your client’s financial objectives while leaving a lasting imprint on our community.

According to recent studies, 91% of high-net-worth individuals donate to charitable organizations. By engaging in conversations about philanthropy with your client, you have an opportunity to deepen your relationship and provide comprehensive, unbiased information so they may make good long-term decisions. The Community Foundation of Greater Greensboro is here to provide philanthropic resources you need.

When Should Advisors Have a Conversation about Charitable Giving?

The Community Foundation of Greater Greensboro makes it easy and meaningful to give back to Greensboro. Just ask the hundreds of individuals, families, businesses, and nonprofit organizations that have partnered with us. Your clients can join in making an immediate and lasting impact by establishing their own fund or giving to one of our existing funds.

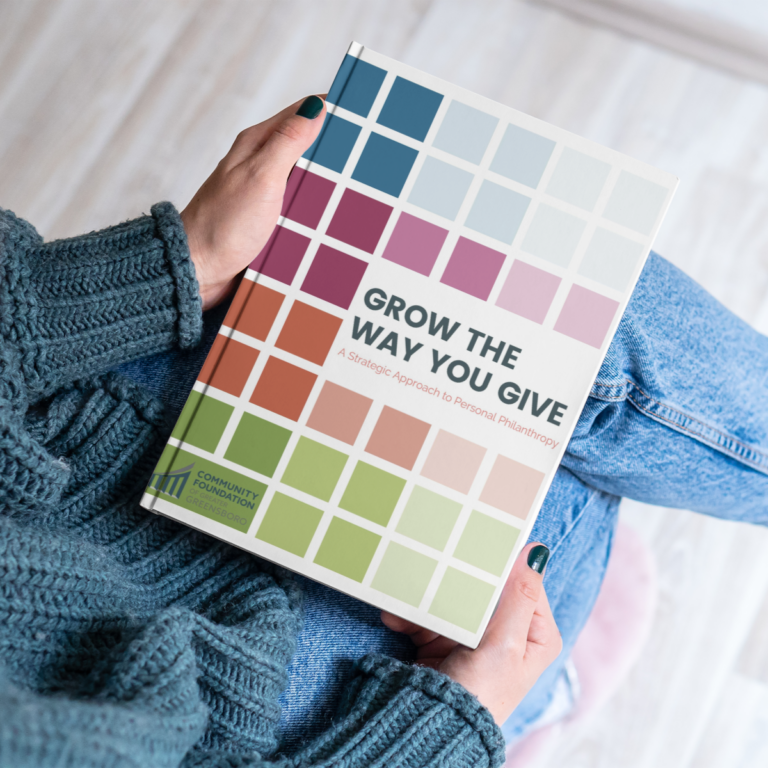

Your clients can use this workbook as they begin thinking about charitable giving.

Whether your clients want to give today or in the future, we can help devise a strategy that matches their philanthropic interests. For more information, contact Cathy Knowles at cknowles@cfgg.org

We take our role as philanthropic experts in our community very seriously, and we are eager to assist you in serving your clients with tax, legal, and regulatory insights and information regarding tax-savvy charitable giving vehicles. Feel free to use the following resources while preparing plans for or meeting with your clients. If you have questions or would like to request that our staff join you in discussions with your clients, contact us.

The Community Foundation of Greater Greensboro offers four primary investment

Talking Philanthropy According to recent studies, 91% of high net

The Community Foundation of Greater Greensboro offers a wide variety

The IRA Charitable Rollover, or Qualified Charitable Distribution (QCD), allows

A Donor Advised Fund at Community Foundation of Greater Greensboro (CFGG) offers the advantages of a private foundation without the set-up costs, ongoing excise taxes, and administrative expenses. Your gift receives more advantageous tax treatment, as well as reduced expenses and burdens, because CFGG is a public charity.

Our goal as a charitable organization is to create a lasting impact in the Greensboro Community. We do this by building strong relationships with philanthropists and nonprofit organizations to understand goals and meet the needs of the community. Visit our blog to read the latest news and see the positive impact on our community when we work together.

Even the best students need a little extra support, and a nonprofit in the Piedmont Triad makes sure students get the help they need.

This Black History Month, the Community Foundation of Greater Greensboro is proud to spotlight the voices of Black leaders serving on our Board. Their leadership shapes our work in meaningful ways, guiding how we invest in community, advance opportunity, and steward philanthropy across our region.

As technology continues to reshape the way we live and